It doesn’t cost any more to have a personal, independent health insurance agent…it pays!

Confused about

Medicare Plans?

Call today! (810) 984-1373

The Annual Election Period for 2024 Medicare coverage is from October 15th, 2023

through December 7th, 2023. This is for coverage starting on January 1st, 2024.

However, if you are aging into Medicare, or via disability give our office a call at (810) 984-1373 to make your appointment today.

These are the Facts

This country is entering a Medicare insurance crisis as insurance premiums continue to rise, while retirement incomes are falling. This fact, in conjunction with increasingly complicated Medicare insurance options, has caused many Medicare recipients to join Medicare plans that are not suitable. This should not be the case. There is no reason you or a loved one should not have the Medicare supplemental coverage you deserve. Please contact me. I will show you all the options available to you.

ATTENTION:

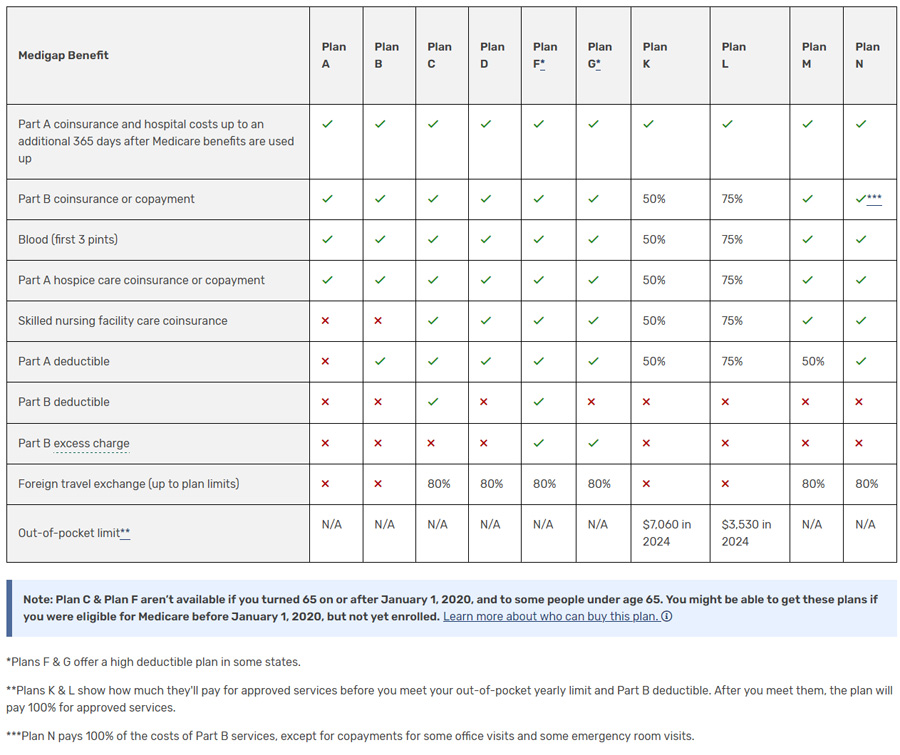

Due to new Medicare rules, plans that cover the Part B deductible are ONLY available to eligible applicants with a 65th birthday prior to 1/1/2023 OR who are age 65 on or after 1/1/2023 AND have a Medicare Part A Effective Date prior to 1/1/2023. Plans C and F are the ONLY plans available that cover the Part B deductible.

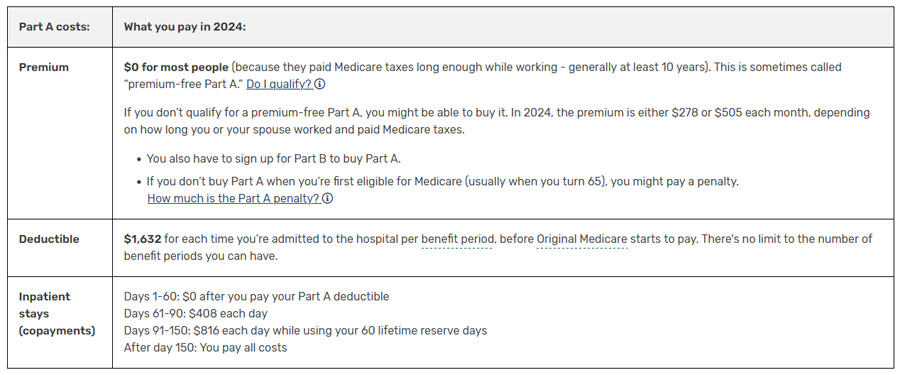

Medicare Part A

Medicare Part A covers hospital care. Most people do not pay a premium for this coverage. Part A can help to pay for care in hospitals and skilled nursing facilities, but not for custodial care in nursing homes. It also may pay for hospice care and some types of home health care.

Click the chart above to see the Part A outline of coverage for 2024.

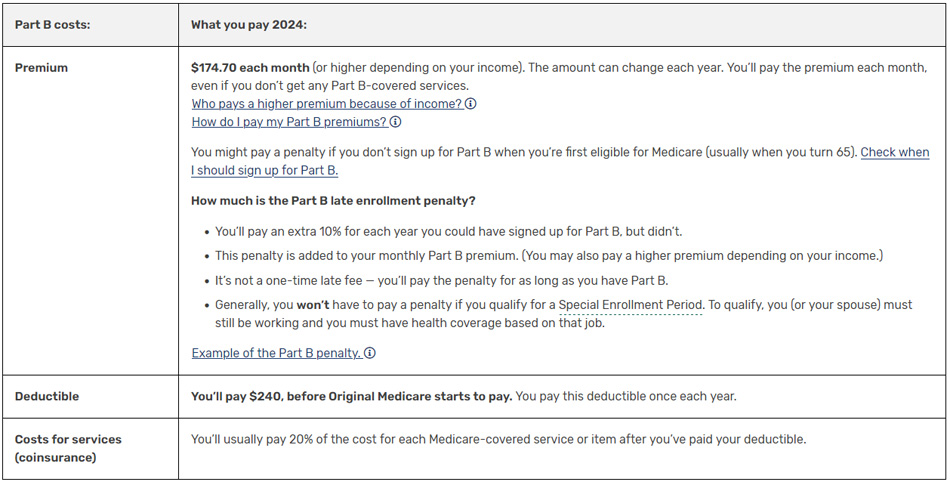

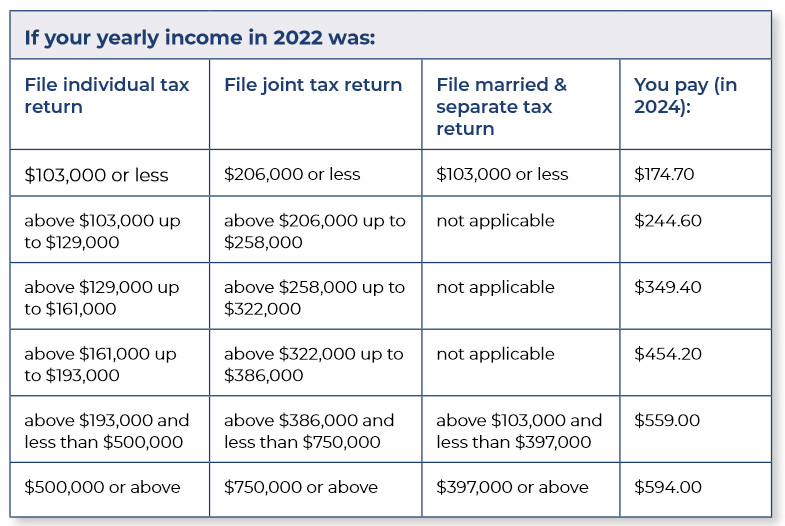

Medicare Part B

Medicare Part B is medical insurance. It covers doctor’s visits, outpatient care, physical and occupational therapy, and some types of home health care not covered under Part A. It may also cover some preventive services. Most people pay a monthly premium for Part B.

Click the chart above to see the Part B outline of coverage for 2024.

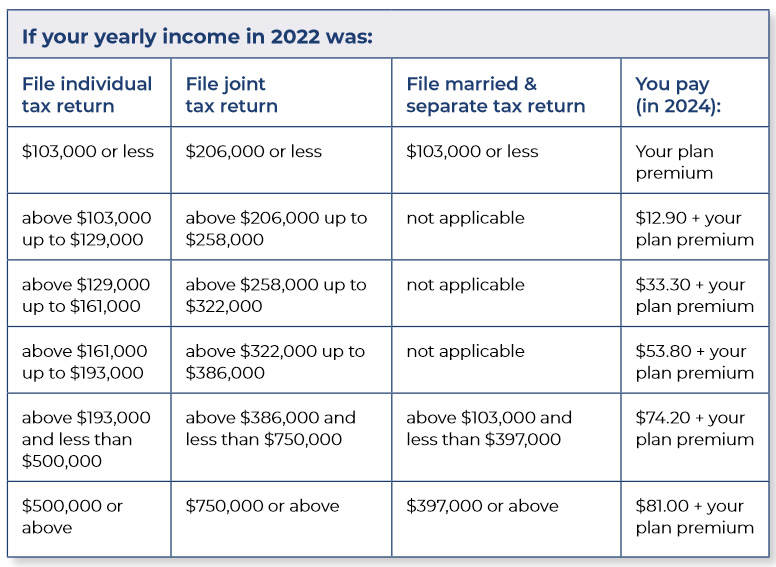

Click the chart above to assess your Part B Premium based off your income and tax filing status.

Medicare Part C

Medicare Part C is a hybrid program that includes the types of coverage provided in Parts A and B. The main difference is that Part C is offered through private insurers approved by Medicare. The products offered by these companies are called “Medicare Advantage Plans”, and they function much like an HMO or PPO. They can fill in many of the gaps in coverage under Parts A and B. They may also provide some coverage for prescription drugs. The cost of these plans is shared by Medicare and recipients. Recipients may choose to pay extra for some types of coverage in these plans.

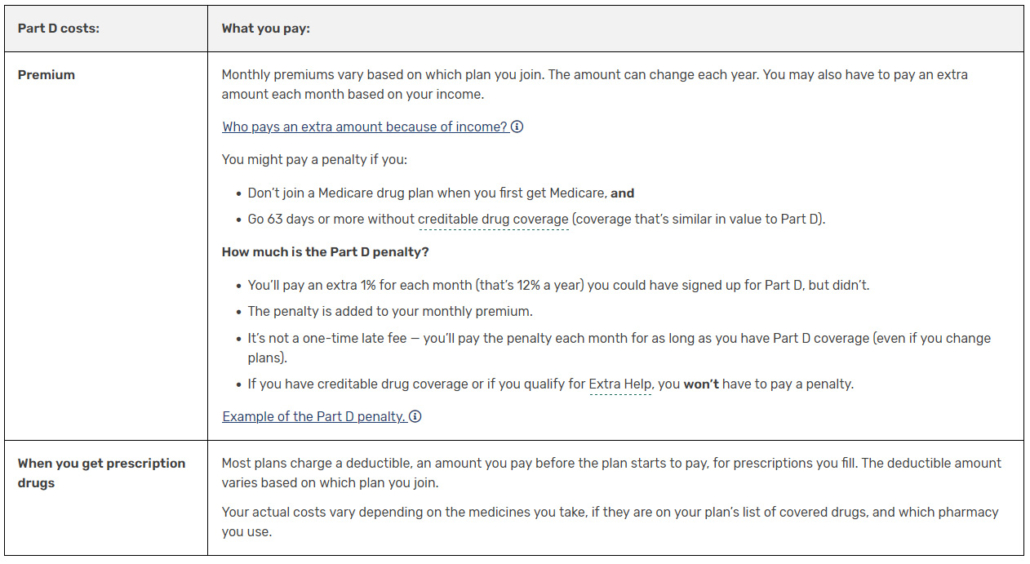

Medicare Part D

Medicare Part D, which provides Prescription Drug Coverage, is the most recent addition to Medicare, Beginning January 1, 2006, everyone enrolled in Medicare became eligible for this program. Part D is intended to lower prescription drug costs. Medicare recipients are not required to join the program, but if they do not join when they are first eligible, they may pay a higher premium if they decide to join later on. Coverage under the program is provided by private insurance companies. Recipients choose a plan and a company and pay a monthly premium for coverage.

Click the chart above to see the Part D outline of coverage for 2024.

Click the chart above to assess your Part D Premium based off your income and tax filing status.

About Medicare Supplemental Insurance

When shopping for Medicare Supplement insurance, you should first understand completely how Medicare works. Since Medicare does not cover all heath care expenses, Medicare supplement insurance is sold as supplemental health insurance for Medicare recipients. There are a number of gaps in Medicare coverage, so this Medicare supplement insurance is often known as Medi-gap. Although health insurance companies provide Medicare supplement insurance coverage, they are strictly regulated by both the federal and state government.

People who are covered under Parts A and B often buy “Medigap” insurance to pay for things not covered by Medicare, such as deductibles and copayments. Medicare has established twelve standard types of Medigap policies. Different types of Medigap polices cover different things. The more comprehensive the coverage, the higher the cost. To get the best deal, you should apply for Medigap insurance when you first become eligible. Then you can buy any type of Medigap policy at the same rate as everyone else, regardless of your health situation. If you wait, an insurer may refuse to sell you certain types of insurance or may charge higher rates.

Third Party Organization Disclaimer

“We do not offer every plan available in your area. Currently we represent three organizations which offer 25 products in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Assistance Program (SHIP) to get information on all of your options.”

Serving the residents of the beautiful Blue Water Area and the Thumb since 1978…

Business Hours:

Our Location

Grant Smith

Insurance Agency, LLC

2916 Pine Grove Avenue

Port Huron, MI 48060

Phone: (810) 984-1373

Fax: (810) 984-1384

Email: grantsmith@grantsmith.com

Located at:

Note:

The Grant Smith Health Insurance Agency is not affiliated with the U.S. Government or Federal Medicare Program.

Third Party Organization Disclaimer

“We do not offer every plan available in your area. Currently we represent three organizations which offer 25 products in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Assistance Program (SHIP) to get information on all of your options.”